Prepayment models are one of the most important features for pricing MBSs. However there is relatively little publicly available information concerning prepayment rates, so it is difficult to construct and calibrate the prepayment models. One model we will focus on is Richard and Rolls's model in which they modeled the conditional prepayment rate (CPR). Remember that the CPR is the rate at which a given mortgage pool prepays, expressed as a percentage of the current outstanding principal level in the mortgage pool, as an annual rate. Most prepayment models are private, and used by banks and investment companies and are usually not in the public sphere.

The Richard and Roll model:

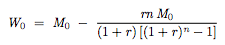

where:

RI(k) is the refinancing incentive, and is based on the weighted average coupon of the mortgage pool (WAC) and the spot risk-free interest rate. It represents the amount of money people could save by prepaying and refinancing their mortgage at a lower interest rate.

AGE(k) is the seasoning multiplier, and captures the fact that mortgage owners are very unlikely to prepay in the time periods directly after taking out a mortgage, and are more likely to prepay later in their mortgage rather than sooner.

MM(k) is the monthly multiplier, and reflects that people tend to prepay in different months of the year and each month is fairly close to 1, but do differ slightly depend on the month in question.

BM(k) is the burnout multiplier and it decreases linearly as the mortgage goes on longer. It simply represents the fact that people who can prepay tend to prepay early rather than later.

We also need to specify a term-structure model in order to fully specify the mortgage pricing model. The term structure model will be used to:

- discount all of the MBS cash flows into the usual risk-neutral pricing framework and

- to compute the refinancing incentive (the spot free interest rate in RI(k)).

Whichever term structure model is used it must be able to compute the relevant interest rates analytically. Such a model would need to be calibrated first. Then actually pricing the MBS requires Monte-Carlo simulation.

The sub-prime mortgage market played an important role in the financial crisis in 2008 and 2009. Sub-prime mortgages were issued to home-owners with very low credit. Adjustable-rate mortgages were used to lure home-owners in with low interest rates for the first two or three years, then the rates were raised very quickly and the home owners were unable to pay. Moral hazard problems of mortgage brokers, rating agencies, inadequate regulation, inadequate risk management, and poor corporate governance were other causes that helped lead to the financial crisis as well.